Cách khôi phục tin nhắn Facebook đã xóa trên Messenger

Hướng Dẫn Khôi Phục Tin Nhắn Đã Xóa Trên Facebook Messenger

Trong thế giới số hiện đại, việc mất mát thông tin quan trọng như tin nhắn trên Facebook Messenger có thể gây ra không ít phiền toái. Tuy nhiên, với bài viết chi tiết này từ QTCland, bạn sẽ được hướng dẫn cách khôi phục tin nhắn đã xóa trên Messenger một cách nhanh chóng và hiệu quả nhất.

Điều Kiện Khôi Phục Tin Nhắn Messenger

Để có thể khôi phục tin nhắn đã xóa, bạn cần đáp ứng một trong những điều kiện sau:

- Tin nhắn chưa bị xóa hoàn toàn khỏi Facebook: Nếu bạn chỉ xóa tin nhắn từ cửa sổ chat, có thể tin nhắn vẫn còn trong hệ thống sao lưu.

- Cuộc trò chuyện đã lưu trữ: Những tin nhắn quan trọng nên được lưu trữ để dễ dàng khôi phục trong tương lai.

- Không xóa toàn bộ cuộc trò chuyện trên Messenger: Khi toàn bộ cuộc trò chuyện bị xóa, tất cả bản sao lưu liên quan cũng sẽ biến mất.

Lưu ý: Để đề phòng, bạn có thể chụp màn hình và lưu lại những thông tin quan trọng.

1. Cách Khôi Phục Tin Nhắn Messenger Trên iPhone

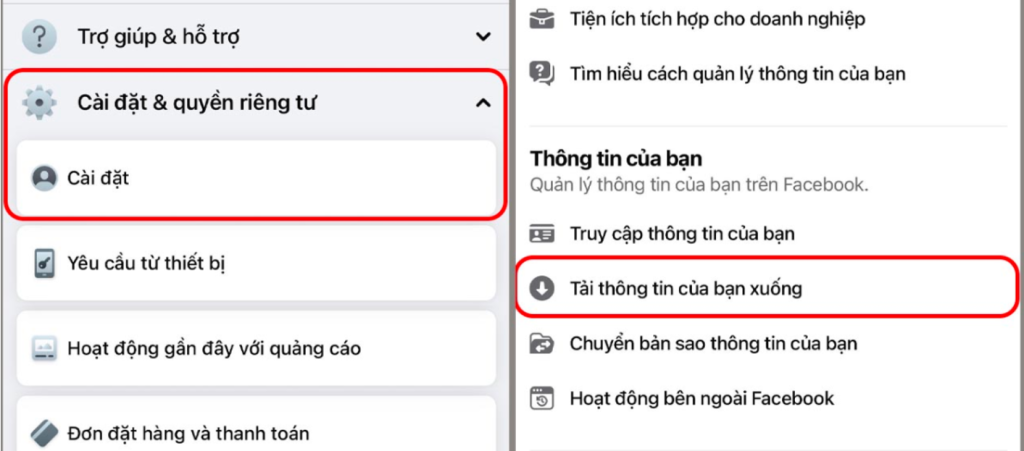

Bước 1: Tải thông tin cá nhân xuống

- Mở ứng dụng Facebook.

- Nhấn vào Menu > Cài đặt & quyền riêng tư > Cài đặt.

- Chọn Tải thông tin của bạn xuống.

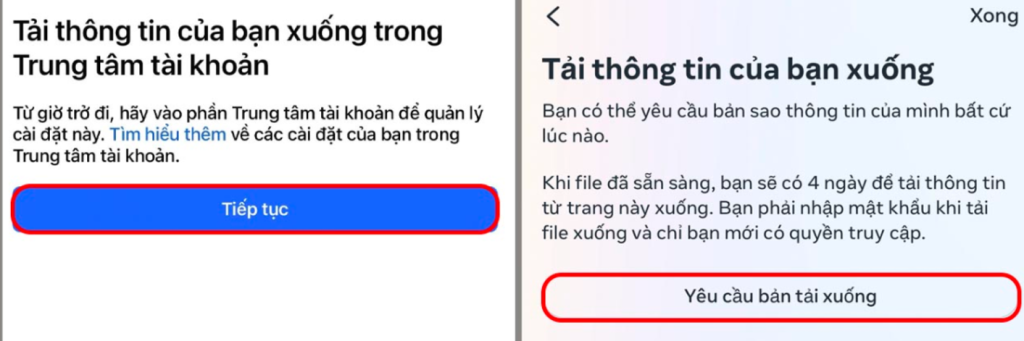

Bước 2: Yêu cầu bản sao tin nhắn

- Chọn Tiếp tục > Nhấn Yêu cầu bản tải xuống.

- Lựa chọn tài khoản và trang cá nhân > Chọn Tin nhắn.

- Nhấn Gửi yêu cầu và đợi Facebook xử lý.

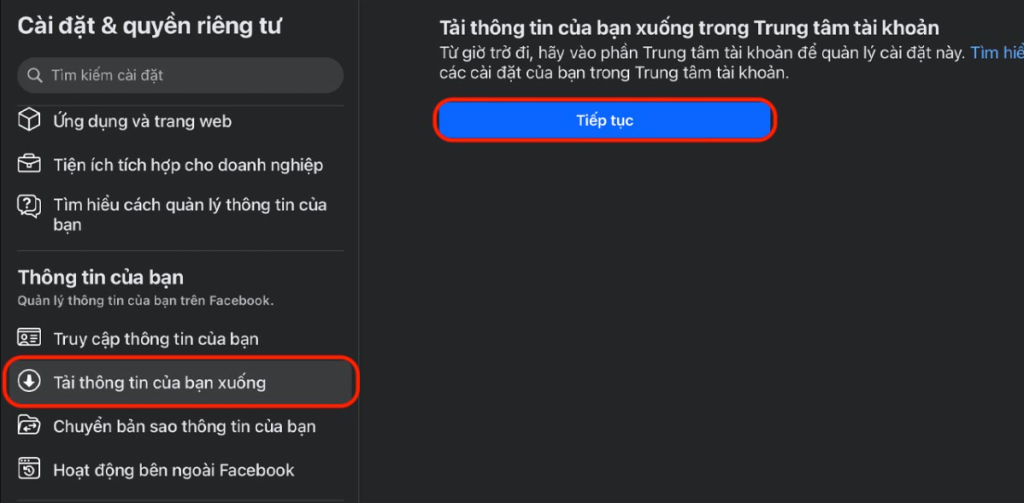

2. Cách Khôi Phục Tin Nhắn Messenger Trên Máy Tính

Bước 1: Truy cập cài đặt Facebook

- Đăng nhập Facebook trên trình duyệt web (MacBook hoặc PC).

- Nhấn vào avatar > Cài đặt & quyền riêng tư > Cài đặt.

Bước 2: Tải dữ liệu

- Chọn Tải thông tin của bạn xuống > Nhấn Yêu cầu bản tải xuống.

- Lựa chọn tài khoản và loại thông tin cần khôi phục > Nhấn Tin nhắn > Gửi yêu cầu.

3. Cách Khôi Phục Tin Nhắn Từ Website Messenger

Bước 1: Truy cập kho lưu trữ

- Truy cập website Messenger.com và đăng nhập.

- Nhấn vào biểu tượng Kho lưu trữ trên giao diện chính.

Bước 2: Khôi phục tin nhắn

- Chọn đoạn chat muốn khôi phục > Nhấn vào biểu tượng dấu ba chấm > Chọn Khôi phục đoạn chat.

4. Sử Dụng Phần Mềm Thứ Ba

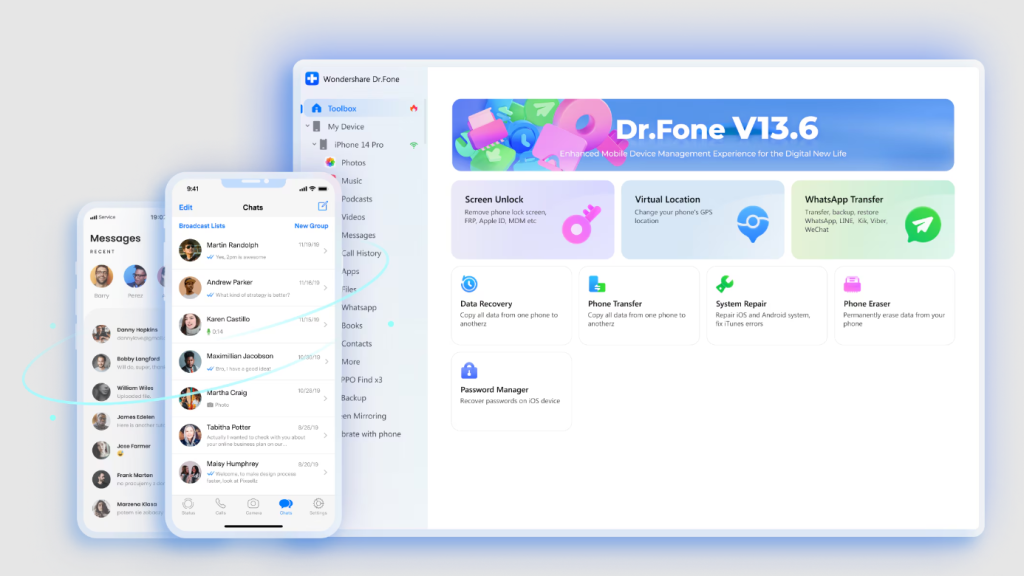

Nếu các phương pháp trên không thành công, bạn có thể tham khảo phần mềm hỗ trợ như Wondershare Dr.Fone:

Bước 1: Tải và cài đặt phần mềm

- Tải phần mềm từ trang web chính thức và cài đặt trên máy tính.

Bước 2: Kết nối thiết bị

- Kết nối iPhone với MacBook bằng cáp USB.

- Mở ứng dụng, chọn Toolbox > Recover Data from iOS Device.

Bước 3: Quét và khôi phục

- Chọn Message & Attachments > Nhấn Start Scan để quét tin nhắn đã xóa.

- Lựa chọn tin nhắn cần khôi phục và hoàn tất quá trình.

Lời Kết

Với những hướng dẫn chi tiết trên, hy vọng bạn có thể dễ dàng khôi phục lại các tin nhắn quan trọng đã bị xóa trên Messenger. Nếu bài viết này hữu ích, hãy chia sẻ cho những người khác cùng biết. Nếu bạn gặp bất kỳ khó khăn nào trong quá trình thực hiện, đừng ngần ngại để lại bình luận để được hỗ trợ kịp thời.

Hy vọng bạn sẽ khôi phục được các tin nhắn quan trọng!

Nguồn Bài Viết Tin nhắn Facebook bị xóa, làm sao khôi phục tin nhắn đã xóa trên messenger